RMD Rules 2024: Age, Penalties, Calculator, and Tax-Savings

Quick Summary

Navigating Required Minimum Distributions (RMDs) can feel like one more thing to add to your retirement to-do list, but missing a deadline could mean hefty penalties. Here’s what you need to know:

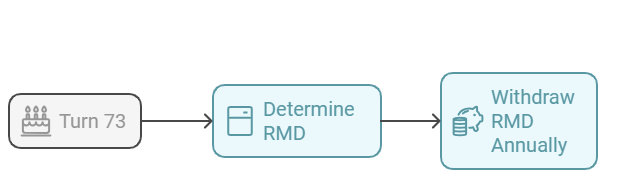

- RMD Starting Age: The SECURE 2.0 Act raised the starting age for RMDs to 73.

- Affected Accounts: Traditional IRAs, 401(k)s, and other tax-deferred accounts.

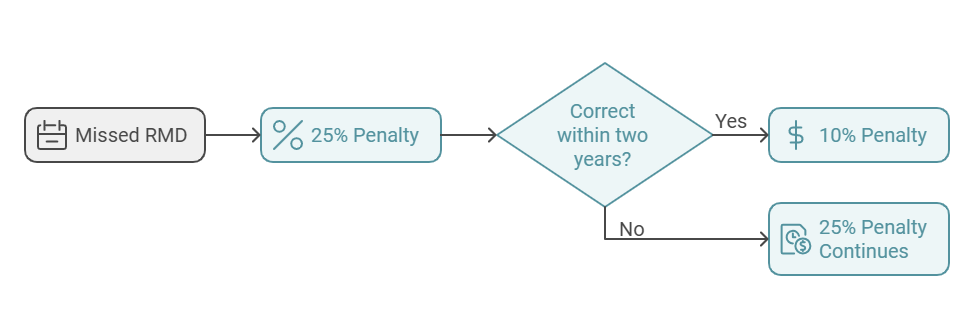

- Penalties: Missed Required Minimum Distribution (RMDs) can result in a 25% penalty, reduced to 10% if corrected promptly.

- Roth 401(k): As of 2024, no Required Minimum Distribution (RMDs) are required during the account owner’s lifetime.

What Are Required Minimum Distributions (RMDs)?

Let’s be real—navigating retirement finances isn’t always a walk in the park. Between balancing budgets and understanding IRS rules, it’s easy to feel overwhelmed. And just when you think you’ve got it figured out, boom—here comes your Required Minimum Distribution (RMD) to shake things up.

But here’s the thing: They aren’t as scary as they sound. If you’re retired or nearing the big RMD age of 73, this guide will walk you through everything you need to know—deadlines, penalties, tax implications, and how to calculate your distribution percentage by age—so you can stay on top of your money (and keep Uncle Sam happy). Think of it as the IRS saying, “Hey, you’ve enjoyed the tax break long enough—time to pay up!”

- Which Accounts Are Affected?

- Inherited retirement accounts

- Traditional IRAs (IRA required minimum distribution rules apply)

- 401(k)s, 403(b)s, and similar plans (401k rules differ slightly)

- SIMPLE IRAs and SEP IRAs

- Which Accounts Are Exempt?

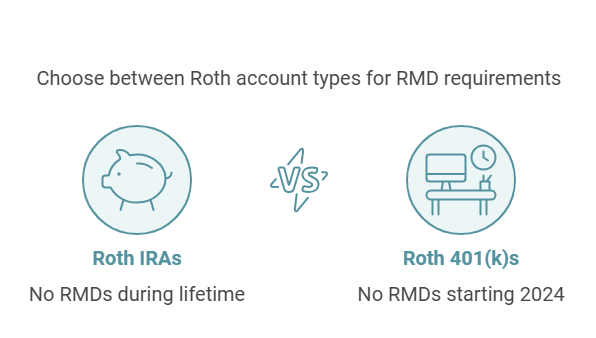

- Roth IRAs (no RMDs during your lifetime)

- Roth 401(k)s (no RMDs starting in 2024)

What Are the Key Changes to the RMD Rules in 2024, Under the SECURE 2.0?

If you’re keeping up with all the retirement news, updates, and changes, you’ve probably heard of the Secure 2.0 Act. It introduced a few updates to the existing law. Just in case you missed it, Office Service Solutions has your back! Here are the quick facts:

- RMD Age Increase: The age to start taking your required minimum distributions is now 73 (up from 72). If you turn 73 in 2024, you must take your first distribution by April 1, 2025.

- Roth 401(k) Update: Starting this year, Roth 401(k) accounts no longer require RMDs during the account holder’s lifetime. (Is it party time yet?)

Why It Matters: You now have more time to let your tax-deferred savings grow before the IRS steps in. And if you’ve got a Roth 401(k), you can leave it untouched for even longer.

Tip: Don’t miss that April 1 deadline for your first required distribution, or you’ll owe penalties—and trust us, the IRS isn’t cutting you any slack on this one.

How to Calculate Your Required Minimum Distribution (RMD) for 2024: Interactive Calculator Below!

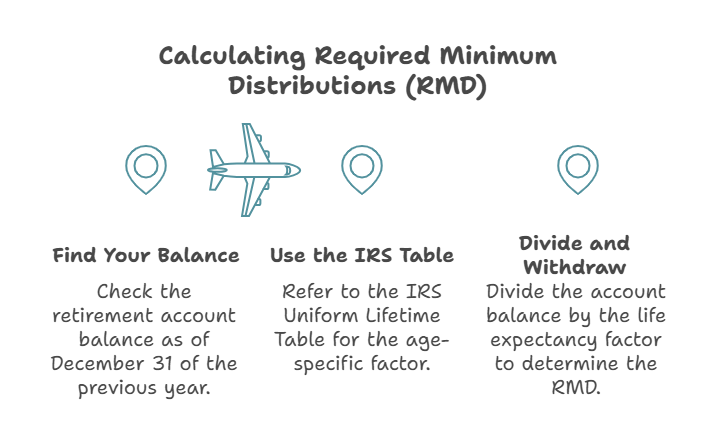

Okay, so calculating your RMD might sound just a tad complicated, but it’s really just a simple formula:

Account Balance ÷ Life Expectancy Factor = Your Minimum Distribution.

- Step-by-Step:

- Use the IRS Table: Refer to the IRS Uniform Lifetime Table to find the RMD percentage by age (your age-specific factor).

- Divide and Withdraw: Divide your balance by the factor to determine your required minimum distribution.

- Example:

- Account Balance = $200,000

- Life Expectancy Factor = 25.6

- RMD = $200,000 ÷ 25.6 = $7,812.50

RMD Calculator

- RMD Age 73: For individuals turning 73 in 2023 or later.

- Penalty: Missed RMD may face 25% tax (10% if corrected in 2 yrs).

- QCD: If 70½+, up to $105k (2024) can be donated from IRA to charity, tax-free count for RMD.

- Inherited IRAs: 10-year rule or Single Life Expectancy. Spouses can do special election.

- Roth IRAs: No lifetime RMD for owner, but beneficiaries have RMD after death of owner.

Consult IRS Pub. 590-B or a tax advisor for exact guidance.

Not a fan of math? We get it! That’s where Office Service Solutions steps in. We’ll calculate your required minimum distribution, keep you 100% compliant, and make sure Uncle Sam doesn’t take more than he should.

Tax Implications of RMDs

Here’s the reality: RMDs are taxable income. They’re added to your annual income, which could push you into a higher tax bracket.

If you miss an RMD, you face a 25% penalty (reduced to 10% if fixed within two years).

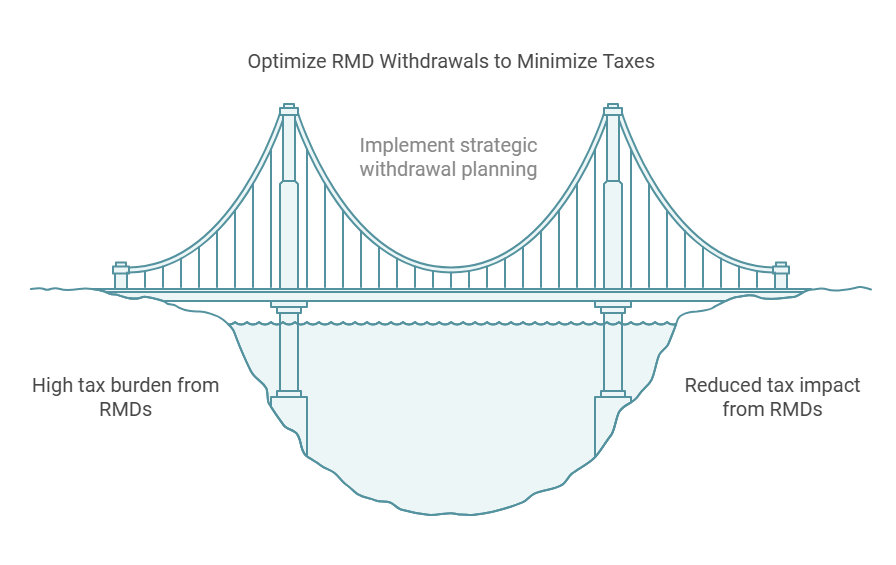

Innovative Strategies to Reduce the Tax Hit:

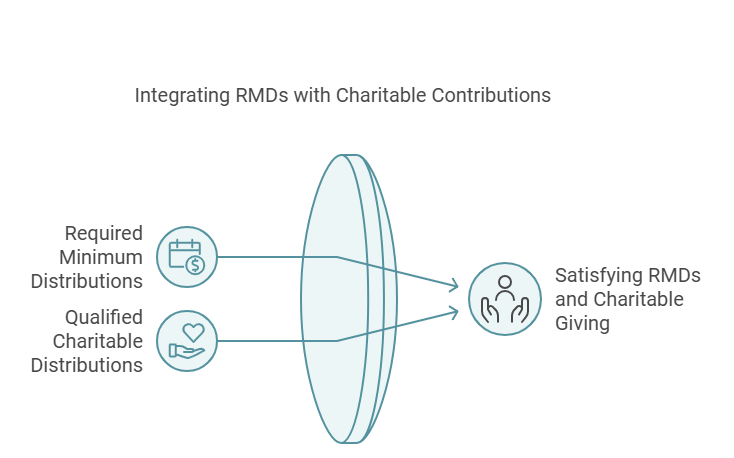

- Use a Qualified Charitable Distribution (QCD) to donate up to $105,000 to a charity tax-free. The will be raised to $108,000 in 2025!

- Spread withdrawals across multiple accounts to manage taxable income.

- Work with professionals to time withdrawals effectively.

Tip: RMDs are unavoidable, but careful tax planning can save you money in the long run.

FAQs: Your Most Common RMD Questions Answered

Q: What is the Required Minimum Distribution for 2024? A: Your RMD depends on your age and account balance. For most, it starts at age 73 due to RMD Secure 2.0 Act changes.

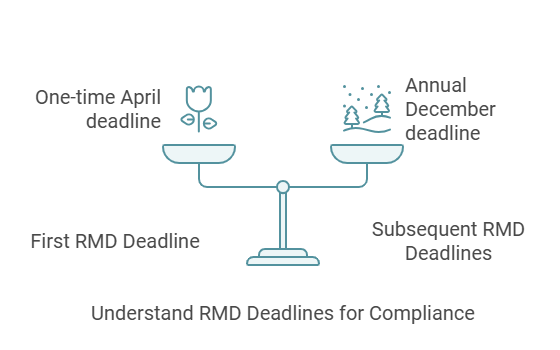

Q: At what age do I need to start taking RMDs? A: Your first RMD is due April 1 of the year after you turn 73. Subsequent Required Minimum Distributions must be taken by December 31 each year.

Q: What happens if I miss my RMD? A: You'll face a 25% penalty on the amount not withdrawn. Correct it within two years, and the penalty drops to 10%.

Q: Do Roth IRAs and Roth 401(k)s require RMDs? A: Roth IRAs: No RMDs during your lifetime. A: Roth 401(k)s: No Required Minimum Distributions starting in 2024! Woo-hoo!

Q: Can I use RMDs for charity? A: Yes, through a Qualified Charitable Distribution (QCD). You can donate up to $105,000 tax-free while satisfying your RMD requirement. This will bump up to $108,000 in 2025!

Q: Are RMDs taxable? A: Yes, RMDs are taxed as ordinary income, which may push you into a higher tax bracket.

IRS Tools and Resources

- Here are official IRS resources to help you navigate your Required Minimum Distribution:

How Office Service Solutions Can Help

Dealing with Required Minimum Distributions isn’t just about withdrawing money—it’s about staying compliant, minimizing taxes, and making the absolute most of your retirement savings. After all, it’s your money!

At Office Service Solutions, we:

- Calculate Your Distributions: No guesswork, no penalties, no-nonsense.

- Create Tax-Saving Strategies: Optimize withdrawals to reduce your tax burden.

- Ensure IRS Compliance: Stay on top of deadlines and changing rules.

Take Control of Your RMDs Today

Retirement should be about relaxation—not worrying about tax deadlines and penalties. Let Office Service Solutions take the stress out of retirement so you can focus on what truly matters.

Schedule your free consultation today, and let us make your retirement planning seamless and stress-free!