How Long Should You Keep Tax Returns and Other Important Documents?

Quick Summary:

- Tax Returns: At least 3 years, or up to 7 years for specific claims

- Business Records: At least 10 years

- Property Records: Keep them forever

- Health & Life Insurance Policies: Keep permanently

If you’ve ever asked yourself, “How long should I keep my tax returns?” you’re not alone. The IRS offers guidelines, but they can be a little tricky to navigate. Holding the proper documents can protect you during an audit, ensure accurate Social Security benefits, and save you stress.

At Office Service Solutions, we’ve guided countless individuals and businesses through proper record retention. Below, we’ll break down what to keep and for how long, plus share tips for staying organized year after year.

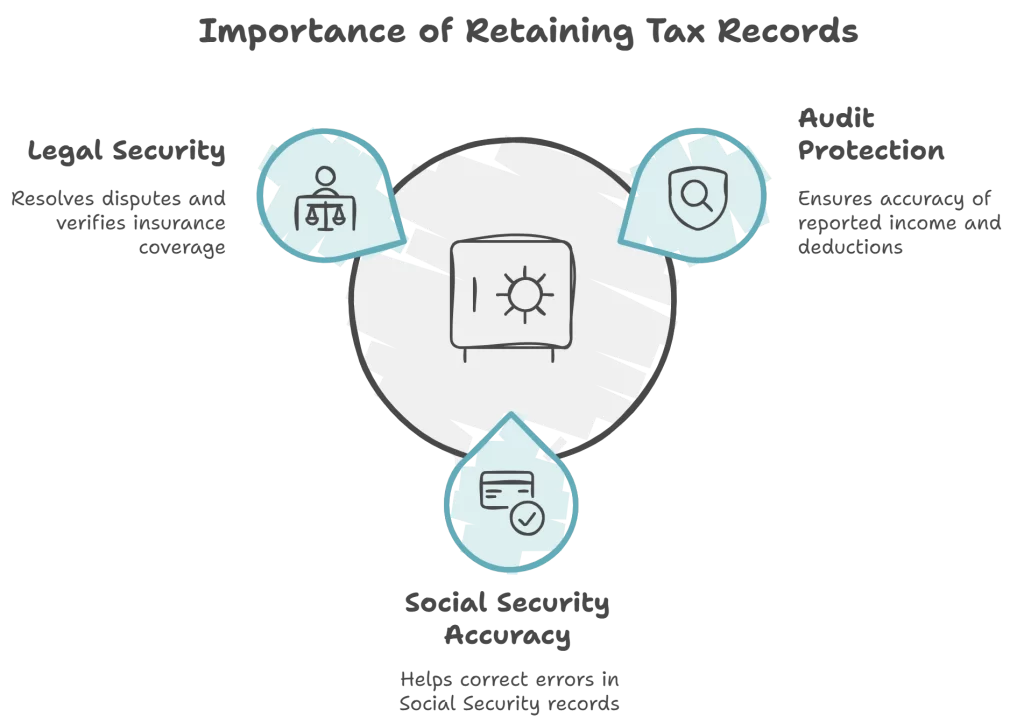

Why Should I Keep My Tax Records?

Your tax documents are more than just paperwork—they’re a safety net. Here’s why retaining them matters:

- Audit Protection: Tax returns and supporting documents confirm your reported income, deductions, and credits.

- Social Security Accuracy: Old income documentation can help fix errors in your Social Security records.

- Legal and Financial Security: Property records and health insurance paperwork can resolve future disputes or verify coverage.

In short, well-kept records shield you from unexpected headaches—long after the current tax season ends.

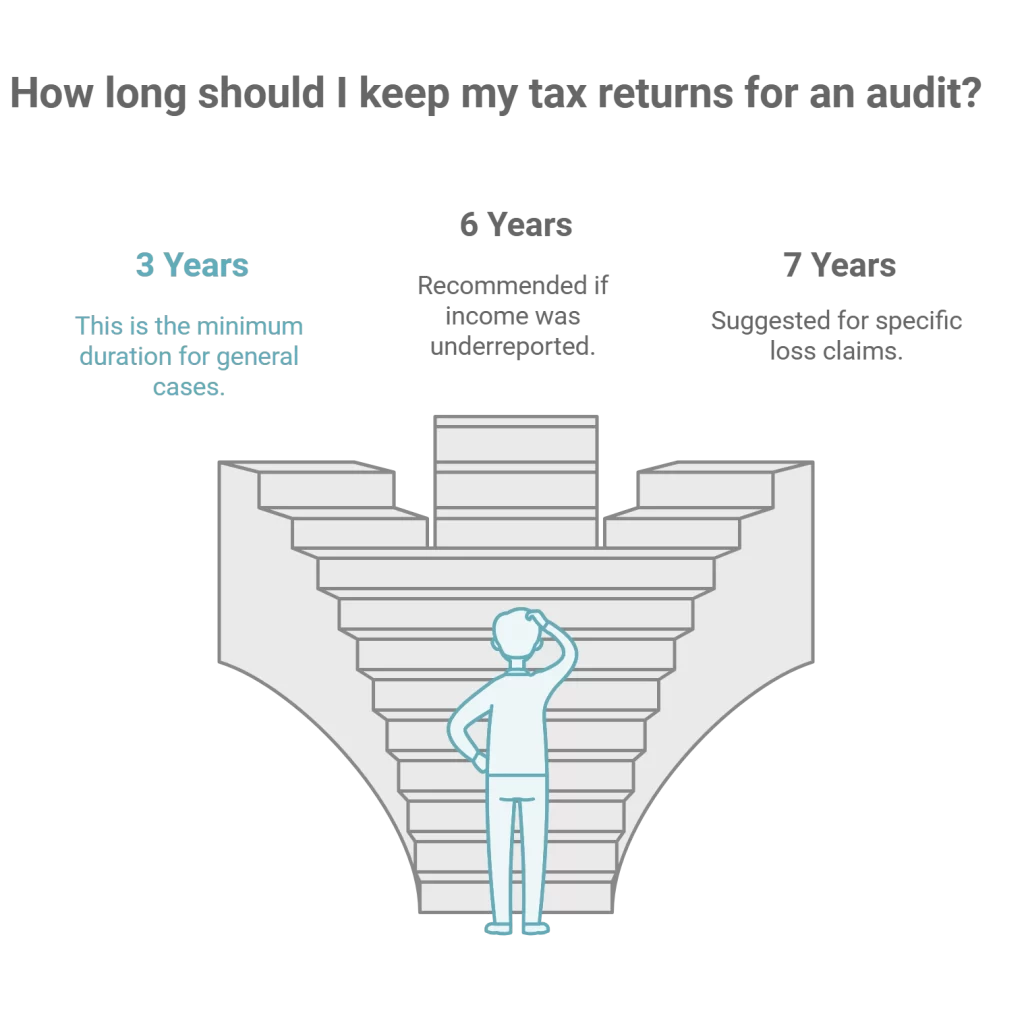

How Long Should I Keep My Tax Returns and Other Documents?

Tax Returns and Supporting Documents:

- Generally: Keep at least 3 years from the date you filed.

- If you have underreported income, keep it for 6 years.

- If You Filed Loss Carrybacks or Credits: Keep them for 7 years.

Business Income and Expense Records:

- At Least 10 Years: These records justify deductions and keep you compliant during audits.

Property Records:

- Keep Indefinitely: Whether it’s a deed, a sale agreement, or records proving your home’s value, never toss these out.

Health and Life Insurance Policies:

- Save Permanently: You may need them at any time to verify coverage or support claims.

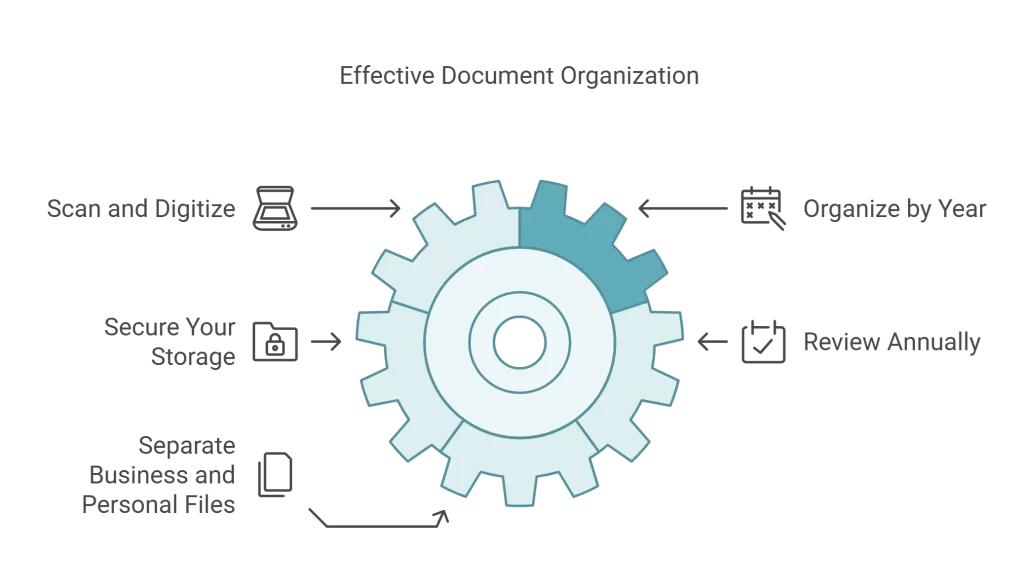

How Can I Stay Organized?

Maintaining tidy records doesn’t have to be complicated. Here are some practical tips:

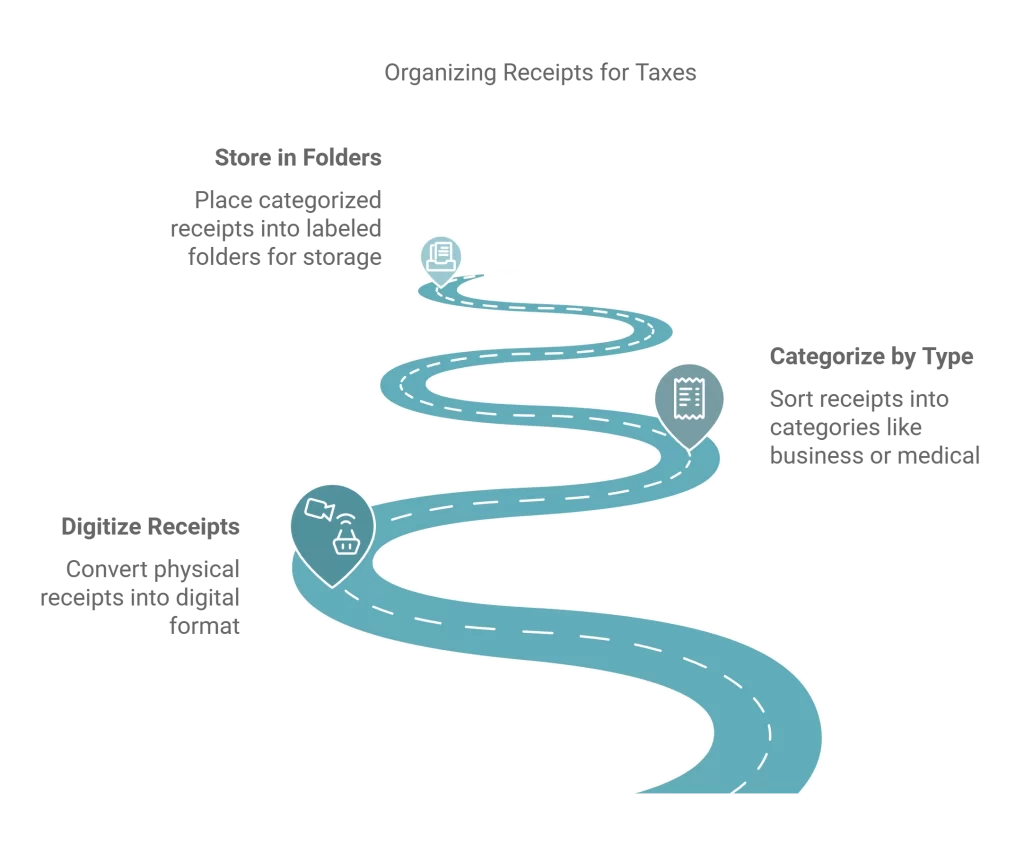

- Scan and Digitize: Use apps or scanners to convert receipts and statements into digital files.

- Organize by Year: Label physical and digital folders by tax year (e.g., “2023 Tax Returns”).

- Secure Your Storage: Keep physical files in a fireproof, waterproof safe; store digital copies in encrypted cloud storage.

- Review Annually: Set aside a time each year to review and safely discard what you no longer need.

- Separate Business and Personal Files: If you’re a business owner, categorizing documents makes tax prep smoother.

By following these steps, you’ll find what you need—when you need it.

FAQs: Your Most Common Questions Answered

Q: How long do I need to keep tax returns for an audit?

A: At least 3 years, but go up to 6 or 7 years if you underreported income or filed specific loss claims.

Q: Can I toss my receipts after filing taxes?

A: Not yet. Hold onto receipts for at least 3 years to support any deductions if questioned.

Q: Do I really need to keep property records forever?

A: Look, property documents aren’t just some stack of paperwork you keep around for no reason. They can settle arguments, show what something’s really worth, and confirm your right to sell when the time comes.

Q: What if I’m missing important documents?

A: If you’ve misplaced a few documents, you still have options. Your bank might be able to pull up old statements, local offices often hold key records, and even the IRS can help fill in the gaps. If you’re sorting out back taxes or trying to correct something from a past return, it could be worth talking to someone who knows the ropes.

Q: Can I file taxes with no income?

A: Yes. You don’t have to bring in a paycheck to make filing worthwhile. In some cases, especially if you qualify for something like the Earned Income Tax Credit, you could still see a benefit even without any earnings.

Q: How should I organize my receipts for taxes?

A: Digitize them, categorize by type (e.g., “Business Expenses,” “Medical Costs”), and store in clearly labeled folders for easy access.

Q: Should I really keep insurance documents forever?

A: Absolutely. Health and life insurance policies may be needed years down the line for claims or coverage verification.

IRS Tools and Resources

The IRS provides helpful options to manage and retrieve records:

- Tax Return Transcripts: Access past returns directly from the IRS website.

- Identity Theft Affidavit (Form 14039): If your personal data is compromised, the IRS offers this form for protection.

- Online Payment Options: Secure platforms let you pay what you owe directly online.

At Office Service Solutions, we can show you how to use these tools effectively, ensuring you remain compliant and secure.

Take Charge of Your Financial Future We get it—no one wakes up excited to wrestle with their tax paperwork. Still, staying on top of it isn’t just about keeping the IRS happy. Think of it this way: you won’t have to tear apart your filing cabinet at midnight to find that one slip of paper if there’s ever an audit, and you’ll know your Social Security details are actually in order. It’s about stepping back and taking a holistic look at your finances, making sure everything fits together so you can stop worrying and get on with your life.

If this all feels like too much to handle on your own, you’re in good company. At Office Service Solutions, we don’t just shuffle papers and crunch numbers. We believe in a holistic approach to your finances—one that goes beyond the bottom line so you can feel more settled in your day-to-day life. Let’s sit down, make sense of it all, and figure out a way forward that actually works for you.